Fulcrum

Product Design

Product Design

Product Design

Web

Web

Web

Transforming a complex insurance workflow into an intuitive, AI-powered experience.

Services

UI Design

Services

UI Design

Services

UI Design

Stack

Figma

Stack

Figma

Stack

Figma

Problem statement

How can I design an AI-powered experience that feels like working alongside a smart co-pilot — upload your files, watch progress unfold, chat to refine insights, and export polished client-ready reports.

Why?

Loss Runs Analysis is one of the most time-consuming processes for account managers and producers at insurance brokerages. Traditionally, running an analysis is a data-heavy task of hours spent parsing dense PDFs, matching policies in Epic (the record system), and calculations to produce insights for clients.

Solution

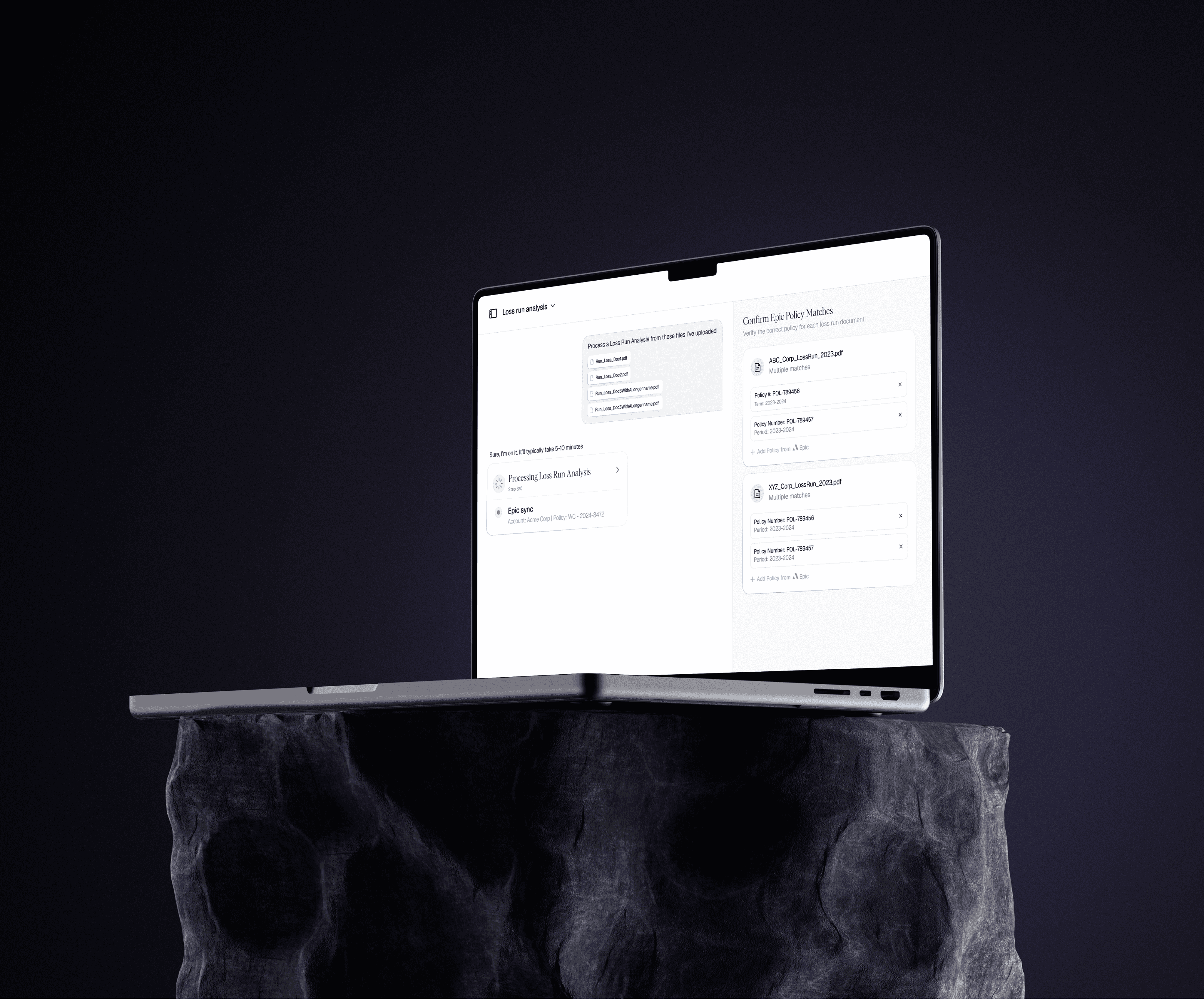

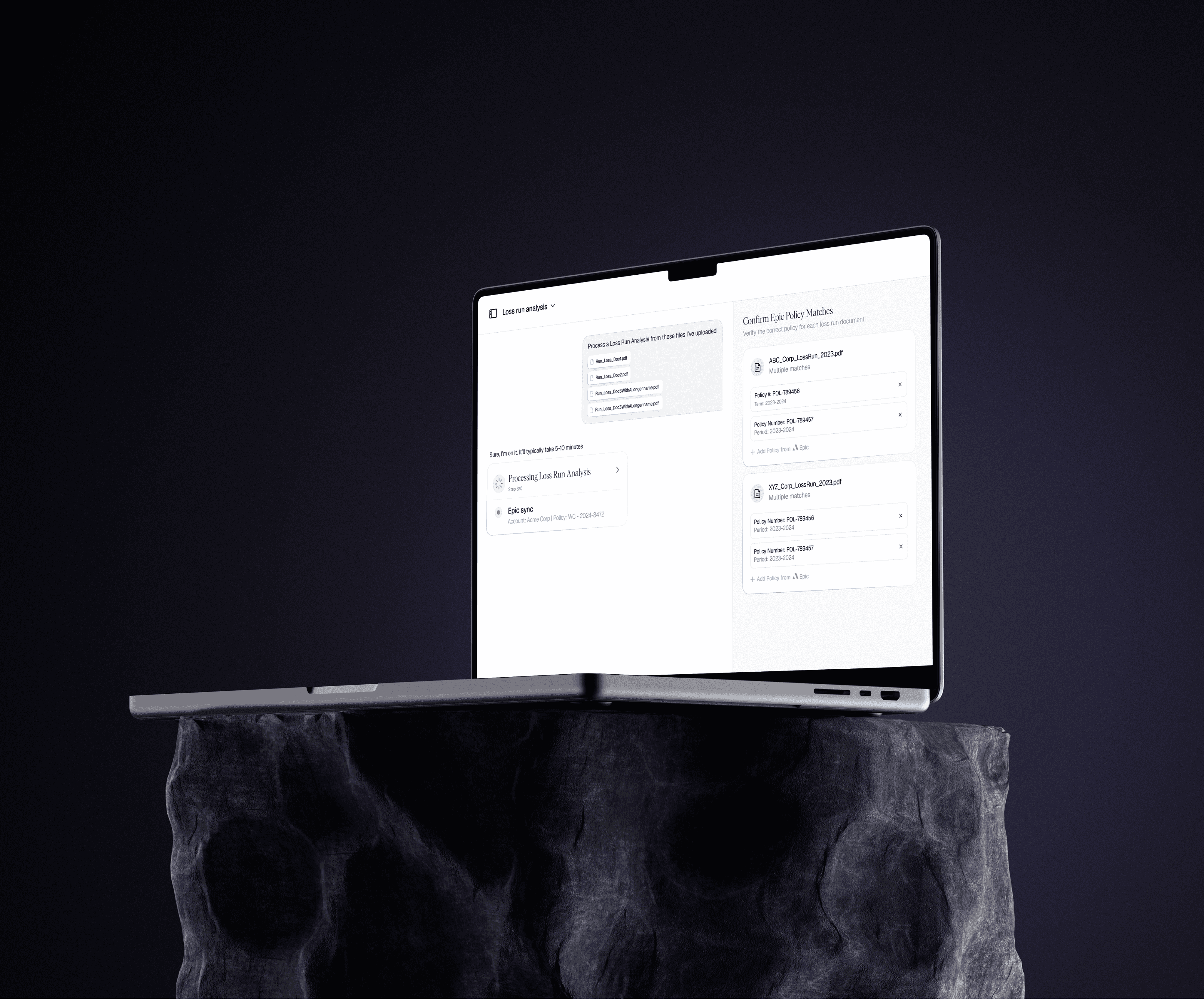

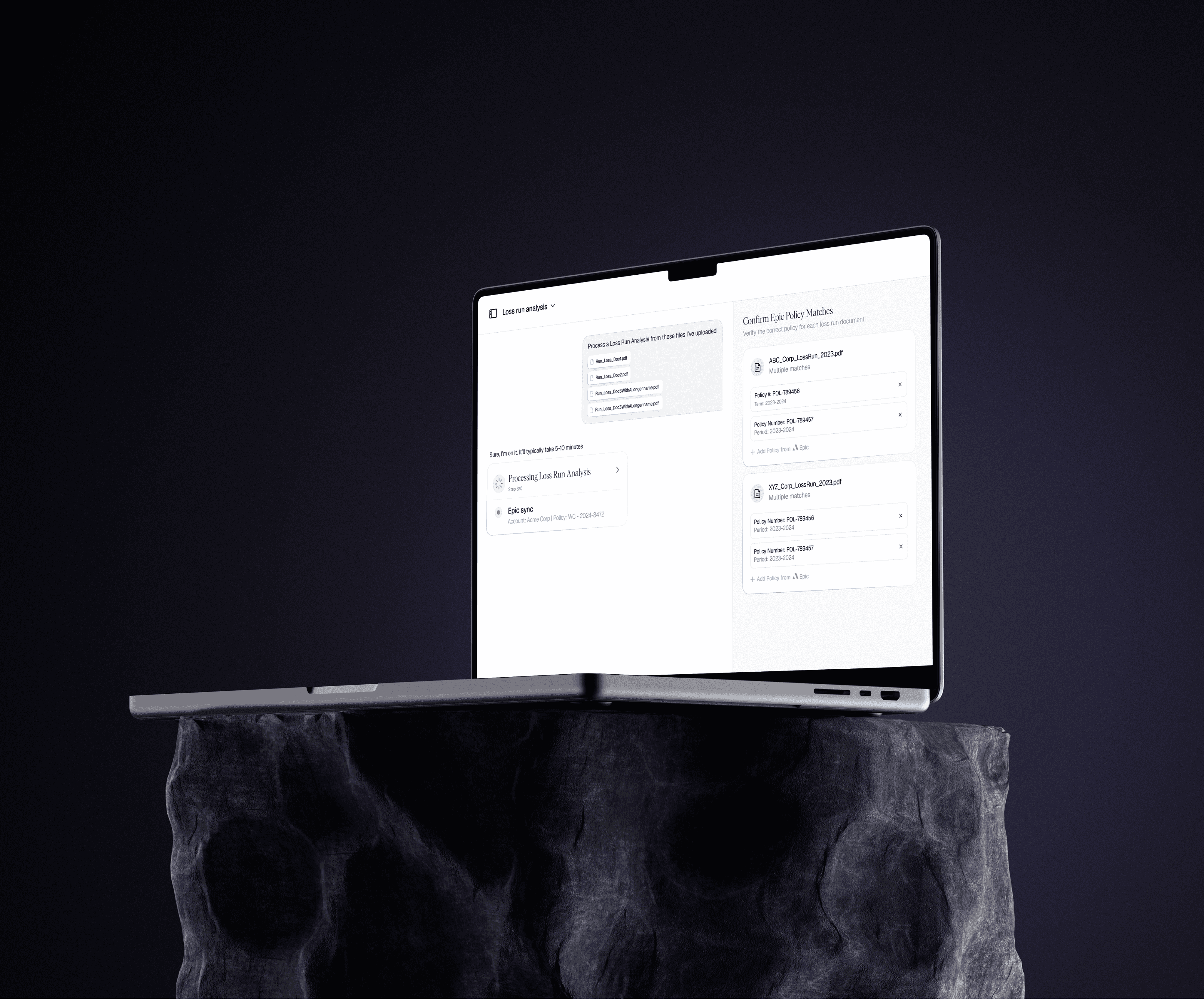

Upload & Processing

Users drag and drop their files and watch real-time progress:

Uploaded → Parsing → Epic Sync → Crunching → Ready.

Each stage reassures users that the data is accurate and connected to the right policy.

Interactive Workspace

The UI splits into two panels for collaboration:

Left: Chat Panel

Conversational controls to filter, summarize, or visualize insights.

Right: Artifact Panel

Dynamic charts showing:

Loss ratios over time

Premiums vs. losses

Top accounts by claims

Key metrics & outliers

Every number is clickable and traceable back to its source data.

Export & Share

When finished, users can download their work in Excel, PowerPoint, or PDF — or save sessions to revisit later.

Key Features

Batch Upload of PDFs and Excel files

Progress Tracker with clear parsing and syncing states

Interactive Artifact that updates dynamically via chat

Traceable Metrics connected to Epic and source files

One-Click Exports for Excel, PowerPoint, and PDF

Upload & Processing

Users drag and drop their files and watch real-time progress:

Uploaded → Parsing → Epic Sync → Crunching → Ready.

Each stage reassures users that the data is accurate and connected to the right policy.

Interactive Workspace

The UI splits into two panels for collaboration:

Left: Chat Panel

Conversational controls to filter, summarize, or visualize insights.

Right: Artifact Panel

Dynamic charts showing:

Loss ratios over time

Premiums vs. losses

Top accounts by claims

Key metrics & outliers

Every number is clickable and traceable back to its source data.

Export & Share

When finished, users can download their work in Excel, PowerPoint, or PDF — or save sessions to revisit later.

Key Features

Batch Upload of PDFs and Excel files

Progress Tracker with clear parsing and syncing states

Interactive Artifact that updates dynamically via chat

Traceable Metrics connected to Epic and source files

One-Click Exports for Excel, PowerPoint, and PDF

Upload & Processing

Users drag and drop their files and watch real-time progress:

Uploaded → Parsing → Epic Sync → Crunching → Ready.

Each stage reassures users that the data is accurate and connected to the right policy.

Interactive Workspace

The UI splits into two panels for collaboration:

Left: Chat Panel

Conversational controls to filter, summarize, or visualize insights.

Right: Artifact Panel

Dynamic charts showing:

Loss ratios over time

Premiums vs. losses

Top accounts by claims

Key metrics & outliers

Every number is clickable and traceable back to its source data.

Export & Share

When finished, users can download their work in Excel, PowerPoint, or PDF — or save sessions to revisit later.

Key Features

Batch Upload of PDFs and Excel files

Progress Tracker with clear parsing and syncing states

Interactive Artifact that updates dynamically via chat

Traceable Metrics connected to Epic and source files

One-Click Exports for Excel, PowerPoint, and PDF

Research

Below are insights gathered from user interviews with account managers and producers across mid-size brokerages on how they currently manage Loss Runs.

Key insights:

Manual pain: Hours spent copying data from PDFs into Excel.

Disconnection: Policy numbers often mismatched with Epic.

Overload: Difficult to extract insights quickly for client meetings.

Need for trust: Users wanted transparency in where numbers came from.

These findings informed a design system centered on clarity, control, and traceability — ensuring every number can be traced back to its source.

Below are insights gathered from user interviews with account managers and producers across mid-size brokerages on how they currently manage Loss Runs.

Key insights:

Manual pain: Hours spent copying data from PDFs into Excel.

Disconnection: Policy numbers often mismatched with Epic.

Overload: Difficult to extract insights quickly for client meetings.

Need for trust: Users wanted transparency in where numbers came from.

These findings informed a design system centered on clarity, control, and traceability — ensuring every number can be traced back to its source.

Below are insights gathered from user interviews with account managers and producers across mid-size brokerages on how they currently manage Loss Runs.

Key insights:

Manual pain: Hours spent copying data from PDFs into Excel.

Disconnection: Policy numbers often mismatched with Epic.

Overload: Difficult to extract insights quickly for client meetings.

Need for trust: Users wanted transparency in where numbers came from.

These findings informed a design system centered on clarity, control, and traceability — ensuring every number can be traced back to its source.

Impact

The redesigned workflow reduced the average Loss Runs analysis time from hours to minutes and eliminated manual reconciliation.

The redesigned workflow reduced the average Loss Runs analysis time from hours to minutes and eliminated manual reconciliation.

The redesigned workflow reduced the average Loss Runs analysis time from hours to minutes and eliminated manual reconciliation.